In recent years, however, mergers, particularly among large-cap companies, have not been looked upon so favorably. And the results mostly bear out this skepticism. Consider the merger of Citibank with Travelers. The price of a Citi share at the time of the October 1998 merger was $32.50; today the stock sells below $25. Ten years later, a 25% lower shareholder value. Not a pretty sight.

Or what about the infamous merger of Time Warner with AOL? On January 10, 2000, when the merger became effective, Time Warner stock sold for $71.88. Today you can buy a share of Time Warner for under $15. One of the great evaporations of shareholder value in financial history. And then there’s Vivendi-Seagram. And then there’s…well, you get the picture. Bigger is not necessarily more beautiful.

Most of these ill-fated mergers were the results of misguided intentions. Often, it was the aggrandizing drive that so many managements harbor. Or the competitive “mine is bigger than yours” syndrome. At other times it was a desire for diversification. And, egged on by aggressive investment bankers and a receptive stock market, the deals got done.

But of all the megadeals in the last 10 years that have engendered opprobrium, few have rivaled the negative views of the combination of Hewlett-Packard and Compaq Computer. Announced the week before 9/11, the HP-Compaq merger was met with almost universal skepticism and cynicism. And well after the merger was consummated in mid-2002, the doubts continued.

Today, the merger is nearly six years old. And, surprise, surprise -- it’s turned out to be a sensational combination, whether measured by market share, market leadership or increased shareholder value.

Before going further, I should disclose that from shortly after its founding in 1982 until the year 2000, I was non-executive chairman of Compaq Computer. Retiring a year before the HP merger was announced and two years before it became effective, I had neither knowledge of nor participation in the deal. Another disclosure – I currently own no stock in Hewlett-Packard. I’m simply an interested (analytically, not financially) observer.

When I heard about the merger upon its public announcement, I thought to myself, this sounds like a terrific deal. I knew a lot about Hewlett-Packard, and obviously, a lot about Compaq Computer. And what I knew was this: most of Hewlett-Packard’s weaknesses were complemented by Compaq’s strengths, and, the converse. In other words, the two should fit together tongue in groove. This was a merger of two big companies that ought to work.

But, somehow, this view of was not widely shared. Leading the fight against the merger was a son of HP co-founder Bill Hewlett. This sometime cellist, Walter Hewlett, sat on the Hewlett-Packard board and also on the Hewlett-Packard Foundation board. He controlled a lot of stock. And he became the leader of the opposition to the merger.

Quoted in the New York Times of February 1, 2002, Walter Hewlett said, “The Compaq merger is a dangerously risky, a very costly, step… The risk is great that trying to meld two disparate companies and cultures together in the computer business will come to grief.”

Other observers were equally caustic. Quoted in Time magazine shortly after the merger announcement, Todd Kort, principal analyst for Gartner Research, said, “This is not a case of 1+1 = 2. It’s more like 1+1 = 1.5.”

IDC analyst Roger Kay said, “Dell must be totally gleeful, because these guys are going to spend all their time untangling themselves.”

The competition, of course, was quick to chime in. In the New York Times, unnamed Dell Computer executives were quoted as saying, “There is a significant opportunity for us…”

Finally, my favorite comment came from the ever-smug Michael Dell, CEO of Dell Computer, who called it “the dumbest deal of the decade.”

Did Hewlett-Packard and Compaq make a colossal mistake? Was this a dumb deal? Or are all these commentators be wrong?

Well, for a while, these Cassandras looked pretty good. After the companies merged, the integration and execution went poorly. Many of the best and brightest from Compaq left, some voluntarily, some not.

CEO Carly Fiorina was the architect of the merger and its champion. She made it happen despite fierce opposition from the Hewlett and Packard family members, their foundations, and from other large shareholders. But while she did the deal, she simply did not have the skills to manage one of the world’s largest technology companies. For almost three years, the company failed to realize the potential of the combined companies. In early 2005, criticism of the company and the merger reached shrill proportions.

Foremost among the naysayers was Carol Loomis, a writer for Fortune magazine. In the issue of February 7, 2005, Ms. Loomis opined: “This was a big bet that didn’t pay off, that didn’t even come close to attaining what Fiorina and HP’s board said was in store. At bottom they made a huge error in asserting that the merger of two losing computer operations, HP’s and Compaq’s, would produce a financially fit computer business…. It must deal with both the relentless competition in computers and its own particular need to battle on two fronts, against both IBM and Dell… Let’s just say one thing: No matter the outcome, the aggressive presence of Dell in the marketplace cannot be good for HP…. In almost everything that HP does today, there’s the shadow of Dell. It is a macho competitor… “

And then her coup de grace: “This merger has been a lemon…Stand up, Walter Hewlett, and take a bow.”

Six weeks after publication of this article that pilloried Hewlett-Packard, the board hired Mark Hurd to replace Fiorina. Only then did the company acquire the management skills needed to take the raw material that was there and transform it into a world leader in technology. In the three years since Hurd became CEO, the results have been truly remarkable. He took the pieces assembled by Fiorina, applied his management skills to them, and created a growing, profitable and increasingly valuable company.

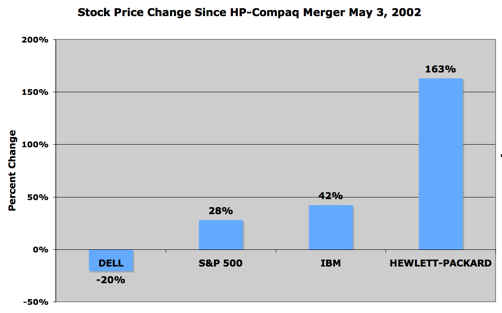

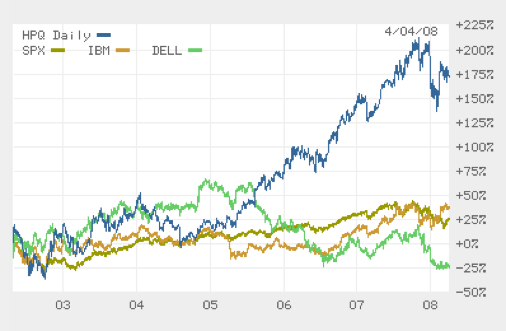

Nothing illustrates the success of the merger better than the chart below. It shows the stock price changes of Dell, IBM and Hewlett since the May 3, 2002, HP-Compaq merger. Dell Computer, once the darling of the business press and industry analysts, has seen its stock price drop 20%. The S&P 500 has risen 28% and IBM 42%. Meanwhile, the once-maligned Hewlett-Packard has seen its stock price soar 163%! So much for a lousy merger.

Where did the pundits go wrong? Well, first of all, they’re pundits. “Those who can, do; those who can’t, opine.” Second, they typically apply conventional wisdom (e.g., all big mergers are bad) rather than analytically looking at whether there is a real fit between the two merging companies. And finally, for the initial three years that the merged company was managed by Fiorina and was struggling, the criticism focused on the "folly" of the merger. It’s now clear to all, even to pundits, that the merger wasn't the problem; it was the management. All Hewlett-Packard needed was strong management in order to realize the latent potential of the merged company.

What are the lessons of this story? Well, we might start with this: Generalizations (and conventional wisdom) are not always true (generally speaking). And then this: Technology pundits are about as prescient as political pundits (and we know how good they are).

Another lesson: Dell Computer at the time was lauded by analysts and the business press as having the best computer industry model, the model for alltime. Now, in hindsight, it seems that the Dell model was the model for a time, not all time -- and that time has long passed.

By the way, we haven’t heard much from Walter Hewlett recently. On the day of the 2001 Hewlett-Packard board meeting that discussed the HP-Compaq merger, Walter was AWOL. Where was he? He was at some musical event playing his cello. My guess is that he is still playing his cello. You might say, then, that “Walter fiddles while HP earns.”

(But will he take a bow?)

Stock Prices Since HP-Compaq Merger May 3, 2002

(Hewlett-Packard, IBM, Dell, S&P500)

Earn online easy money at your door step for about 10$ on just one So go ahead and click here click hurry up!(smart way to make fast money)

ReplyDeletemichael kors outlet

ReplyDeletecoach outlet store

louis vuitton handbags

snow boots outlet

coach outlet

longchamp outlet

true religion jeans

nfl jerseys wholesale

hollister clothing

ugg outlet

burberry outlet

swarovski outlet

ferragamo outlet

michael kors online outlet

fitflops sale clearance

ferragamo shoes

timberlands

ReplyDeletechanel bags

swarovski crystal

coach outlet store

uggs on sale

louboutin femme

louis vuitton outlet online

coach outlet store online

christian louboutin

coach factory outlet online

louis vuitton outlet stores

air max 90

louis vuitton

supra shoes

oakley outlet

louboutin

ray ban sunglasses

michael kors outlet online

jordan 11

abercrombie & fitch

ray ban sunglasses outlet

abercrombie & fitch

lebron 12

instyler max

oakley sunglasses wholesale

ugg boots

louis vuitton bags

louis vuitton purses

true religion outlet

hollister kids

michael kors outlet store

longchamp handbags

coach factory outlet

michael kors outlet clearance

louis vuitton outlet

replica watches

2016128yuanyuan

calvin klein underwear

ReplyDeletehermes bags

pandora outlet

coach handbags outlet

pandora jewelry

true religion jeans

ralph lauren uk

coach outlet

ray ban sunglasses

coach handbags

michael kors canada

rolex watches for sale

ray-ban sunglasses

michael kors outlet

futbol baratas

michael kors outlet

ralph lauren

lebron shoes

montblanc pens

burberry outlet

michael kors uk

longchamp outlet

michael kors outlet

fitflops uk

michael kors outlet online

adidas outlet store

nfl jerseys

nike air force 1

tiffany and co

michael kors outlet

links of london

ray ban sunglasses

kate spade uk outlet

rolex watches

fitflops outlet sale

chanyuan0523

holliste sale

ReplyDeletecoach factory outlet

louis vuitton handbags

the north face outlet

christian louboutin outlet

louboutin uk

hollister clothing

canada goose

borse gucci

oakley sunglasses

20611018caiyan

oakley sunglasses

ReplyDeleteugg uk

north face jackets

polo ralph lauren

tiffany outlet

uggs canada

supra shoes

louis vuitton handbags

ray ban sunglasses

nike roshe run

20161207lck

ReplyDeletecara mengobati darah tinggi secara alami

ciri ciri penyakit stroke

ciri ciri penyakit batu ginjal

cara mengobati radang lambung secara alami

cara mengobati benjolan di belakang telinga

cara mengobati benjolan di leher secara alami

true religion sale

ReplyDeleteray ban pas cher

michael kors bags

coach outlet online

dallas mavericks jerseys

rolex watches

jordan 8

ray ban sunglasses

louis vuitton outlet

ralph lauren outlet

20173.15chenjinyan

oakley sunglasses

ReplyDeletecanada goose outlet

ray ban sunglasses

ralph lauren polo

louis vuitton outlet

louis vuitton outlet

coach outlet

louis vuitton handbags

nike air max pas cher

air jordan

chenlina20170320

tory burch shoes

ReplyDeletecheap soccer jerseys

coach outlet

rolex watches for sale

coach outlet online coach factory outlet

cheap nfl jersey

polo ralph lauren

ralph lauren outlet

cartier outlet

cheap oakley sunglasses

qqqqqing20170406

Zoology Optional for IAS/IFoS

ReplyDeleteStarting from 26th Nov. 2018

Online Class Available

Limited Seats, Join Now

Visit: www.sapiensias.in

Call: 8700922126 || 011-2875 6962 || 9718354962

Email: sapiensias@gmail.com

Address: 17A/44, W.E.A. 3rd Floor, Near Karol Bagh Metro Station (Pillar No. 99), New Delhi- 110005.

https://www.sapiensias.in/course/zoology/zoology-optional-coaching/

Mgiwebzone offer Best Internet marketing services to improve your online presence. No matter which industry your business belongs to, chances are you have to deal with everyday challenges and fierce competition. The experts at MgiWebzone will reshape and redefine your website’s status and standing in the Search Engines.

ReplyDeleteFor more info call us at: (+91) 7503544039

E-mail on info@mgiwebzone.com

Read More at: https://www.mgiwebzone.com

هل طور حامل الإسفنج العفن أو تراكم البكتيريا؟ استخدم فرشاة أسنان مغموسة في مادة مبيضة أو خل أبيض - ولكن لم يأتي ذلك كليهما ، لأن التركيبة تولد تفاعلًا كيميائيًا خطيرًا - لتطهير القالب. اتبع هذا بغسل العلبة الإسفنجية بالماء الشديد الحرارة والصابون أو تشغيلها عبر غسالة الصحون.

ReplyDeleteشركة النجوم لخدمات التنظيف

شركة تنظيف بجدة

شركة تنظيف خزانات بجدة

شركة تنظيف فلل بجدة

شركة تنظيف بيوت بجدة

We wipe it out forever by spraying the excellent pesticides that kill all the existing ants while giving assurance that the termites will not reappear for a certain period.ارخص شركة مكافحة حشرات

ReplyDeleteSpot on with this write-up, I truly think this website needs much more consideration. I’ll probably be again to read much more, thanks for that info.

ReplyDeleteInformation

Click Here

Visit Web

Very nice post, i certainly love this website, keep on it

ReplyDeleteInstabio.cc

Information

Click Here

Visit Web

There are some interesting points in time in this article but I don’t know if I see all of them center to heart. There is some validity but I will take hold opinion until I look into it further. Good article, thanks and we want more! Added to FeedBurner as well

ReplyDeleteAdvancedbusiness.co

Information

Click Here

Visit Web

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

ReplyDeleteBlogtalkradio.com

Information

Click Here

Visit Web

Watch Neeya Naana Show All Latest and Previous Videos at one web portal.

ReplyDeleteÚltima novela brasil Assistir Nazaré atualizações completas de graça

ReplyDeleteexclusive Tamil Serials Episode in watch online HD, all Vijay TV Serial latest episode video

ReplyDelete